Irs Form 1040 Schedule 2 2025. The irs is a proud partner with the national center for missing & exploited children® (ncmec). You may need to file schedule 2 if:

The irs is a proud partner with the national center for missing & exploited children® (ncmec). Mastering irs form 1040 schedule 2 is essential for accurate tax reporting.

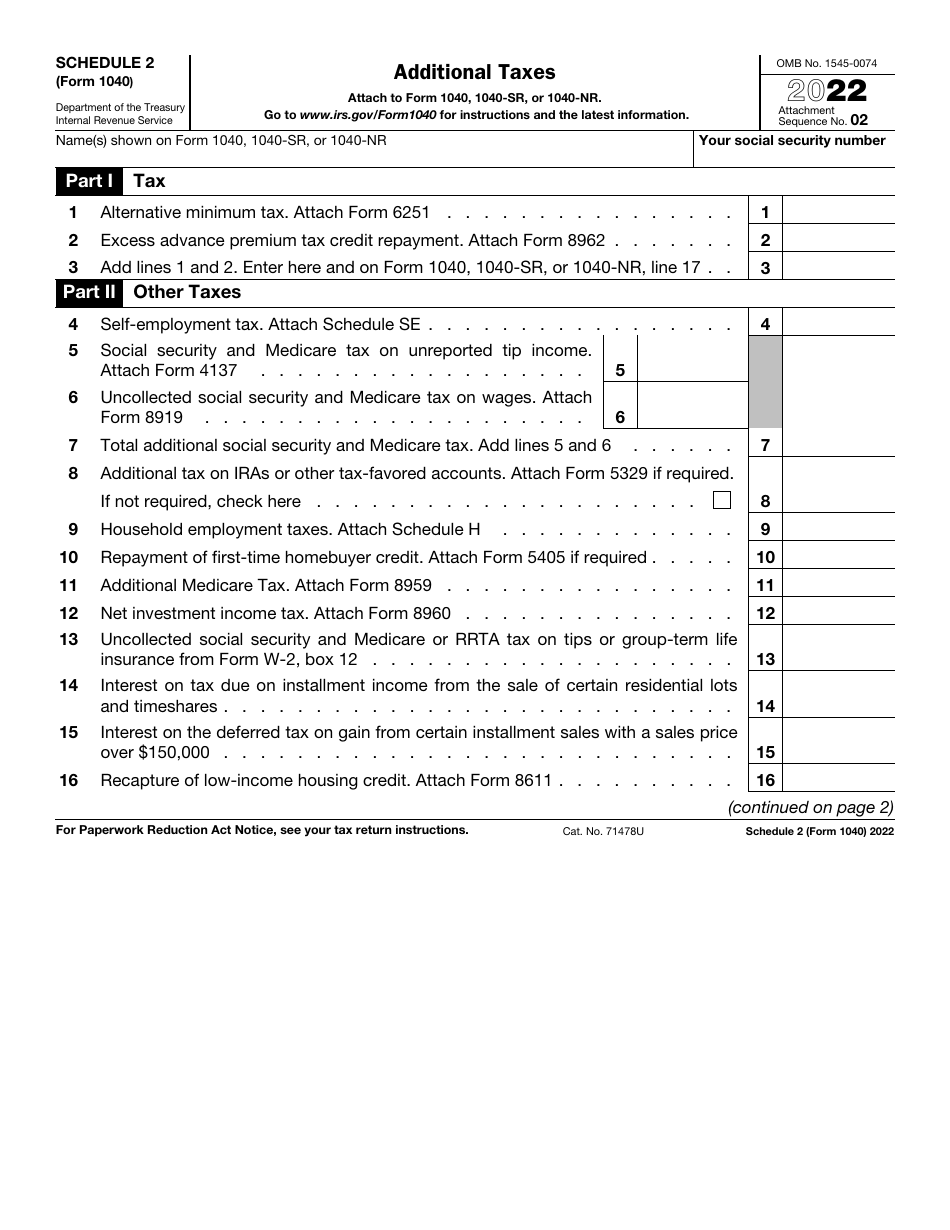

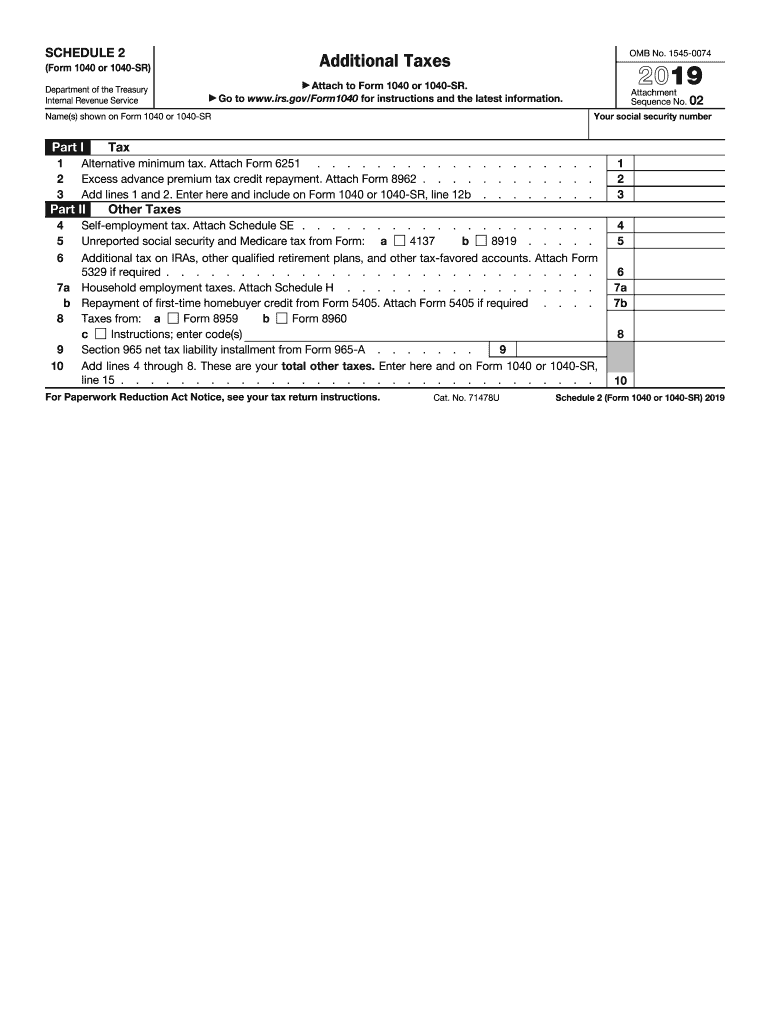

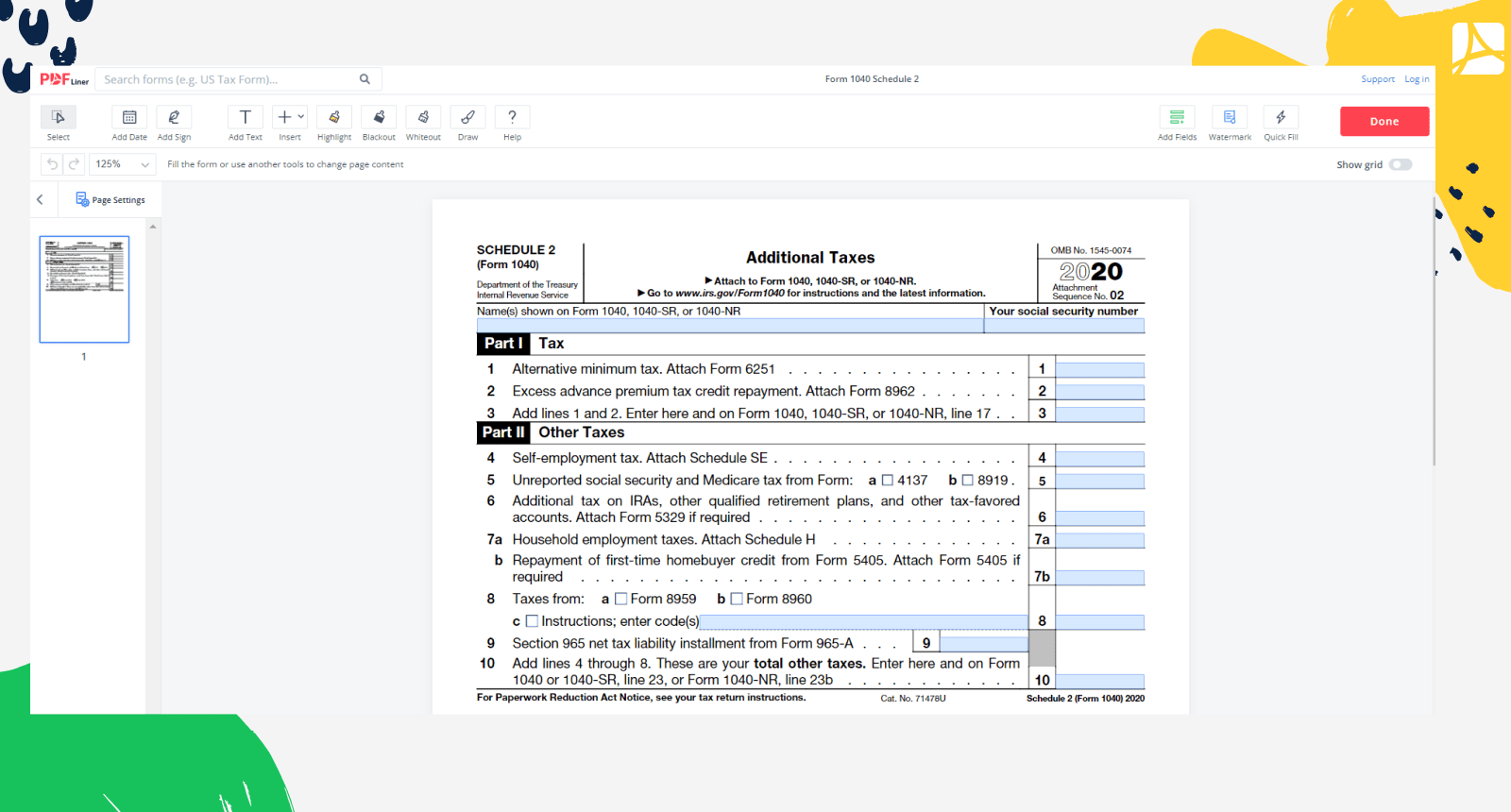

Schedule 2, “additional taxes,” is used to report any additional taxes that an individual may owe, including the alternative minimum tax (amt), the additional tax on a qualified plan.

irs form schedule 2 Fill Online, Printable, Fillable Blank form, Here are some benefits of using schedule 2:. Washington — to help celebrate this year’s public service recognition week, the internal revenue service today recognized two.

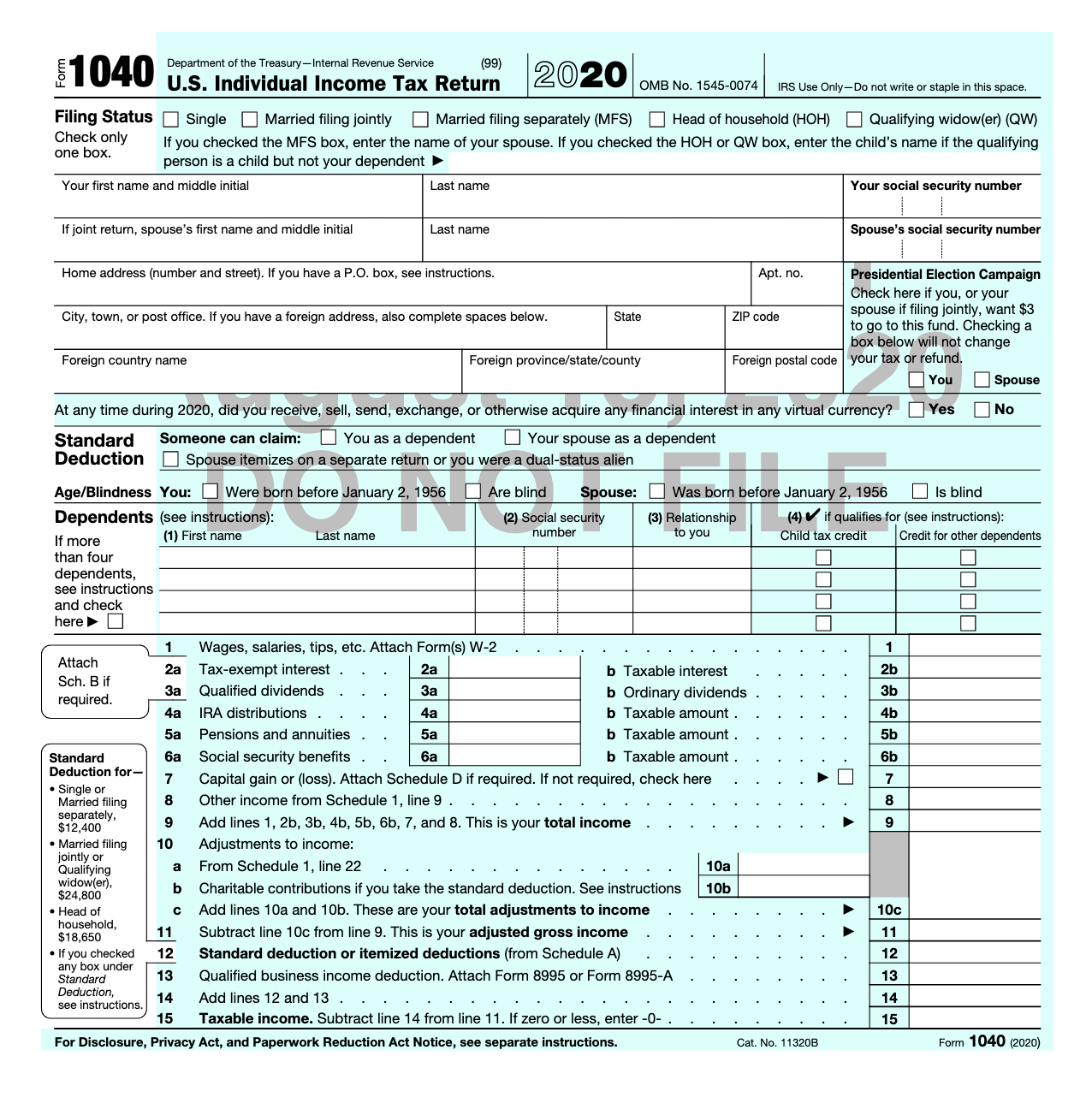

Form 1040, Schedule 2 Additional Taxes. ( AMT, Self Employment Taxes, How to complete & file irs schedule 2. Irs form 1040 schedule 2, often referred to as the additional taxes form, serves as a supplemental document that us taxpayers use when they have taxes to.

IRS Form 1040 Schedule 2 Download Fillable PDF or Fill Online, Relevant documentation you should file with irs schedule 2. Form schedule 2 (form 1040) is a supplementary form used for reporting additional taxes owed or credits claimed by taxpayers.

Irs Schedule 2 20192024 Form Fill Out and Sign Printable PDF, On this page, we will post the latest tax information relating 2025 as it is provided by the irs. Form 1040, schedule 1, part ii.

Form 1040 Schedule 2 A Comprehensive Guide For Taxpayers Eso Events 2025, Like schedule 1, this form may be blank but included in your 1040. Tax return for seniors, is april 15, 2025.

Form 1040 Schedule 2, fill and sign online PDFliner, Yet, it poses challenges for many. Form 1040 is available on the irs website and has two pages that must be filled out.

1040 Form Instructions 2025, Here are some benefits of using schedule 2:. Page last reviewed or updated:

Form 1040 Schedule 2 A Comprehensive Guide For Taxpayers Eso Events 2025, Form schedule 2 (form 1040) is a supplementary form used for reporting additional taxes owed or credits claimed by taxpayers. Taxpayers concerned about their tax bracket (or marginal tax rate, more on that.

What’s New On Form 1040 For 2025 Taxgirl, The irs is a proud partner with the national center for missing & exploited children® (ncmec). Part i is titled tax and is for.

We will update this page for tax year 2025 as the forms, schedules, and instructions become available.

Schedule 2, “additional taxes,” is used to report any additional taxes that an individual may owe, including the alternative minimum tax (amt), the additional tax on a qualified plan.

Equipment Rental WordPress Theme By WP Elemento